NEW YORK, NY – Skanska, a leading global construction and project development firm, has released its Summer 2025 Construction Market Trends Report. Leveraging its Composite Construction Index, the report delivers in-depth analysis and critical insights into the current state of the construction industry, highlighting the impact of tariffs on material availability, project costs, and scheduling.

“Uncertainty has been the defining topic of the construction industry in 2025 as evolving policies and market pressures create unprecedented challenges for owners and builders alike,” said Steve Stouthamer, Executive Vice President of Project Planning at Skanska USA Building. “Despite this, many projects are not only advancing but finding new opportunities, highlighting the critical importance of staying closely connected to the supply chain, shifting market conditions and proactive planning in today’s complex environment.”

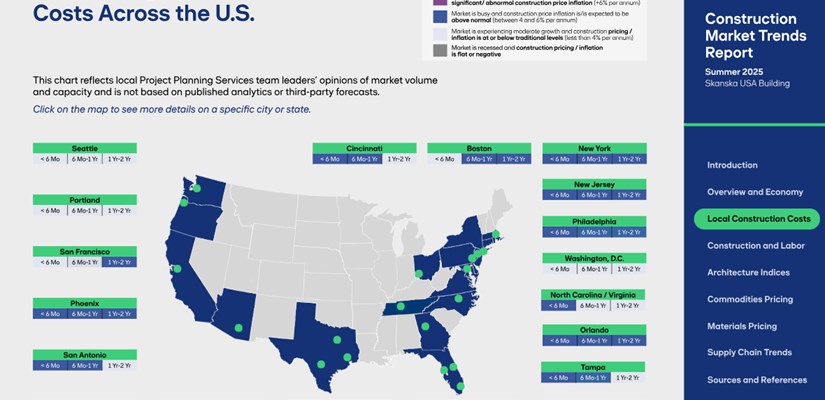

With experience across diverse sectors nationwide and globally, Skanska brings a unique perspective on emerging industry trends, with key report highlights including:

- Total construction starts were up 16% in June 2025 to a seasonally adjusted annual rate of $1.33 trillion, driven by strength in manufacturing and data center construction.

- 17 of the 25 countries targeted by new tariffs account for less than 1% of total US imports.

- As a result, the majority of the new country-specific tariffs that took effect on August 1st are expected to have little to no impact on construction material pricing. The most significant effects will be felt on materials imported from the European Union (EU), Mexico, and Canada. However, goods imported from Canada and Mexico may be eligible for tariff exemptions if they are compliant with the United States-Mexico-Canada Agreement (USMCA).

- Construction costs remain volatile, especially for key materials like copper: in 2025, prices for common copper pipe diameters are up over 40%, while copper wire has risen 14-17% since the start of the year.

- Rising copper costs have driven copper pipe prices up more than 30% in 2025, wide flange steel prices increased nearly 10% including a $40 per ton jump in June, the average price of one yard of concrete is up 9% year-over-year with minor tariff impacts since three-quarters of U.S. cement is produced domestically, and mineral wool insulation prices increased by 8% in July, driving bid prices higher.

- Construction unemployment remained unchanged in July at 3.4%, driven mainly by nonresidential increases, while year-over-year construction employment grew by 1.2%, though only 2,000 jobs were added that month.

- Skanska’s Composite Construction Index shows an annual increase of nearly 4.5% in key trades, contributing to a 3.4% rise in the overall Composite Index for the 12 months ending in August, which is almost a full percentage point higher than the ENR indices.

- Lead times for HVAC equipment remain stable but a 10-12% price increase is expected in 2025 due to tariffs and demand, lead times for large data center generators have improved but still range from 37 to 104 weeks, and electrical gear lead times are decreasing yet remain high for switchgear, switchboards, and transformers, with prices up 8-10% driven by tariffs and demand.

On Thursday, August 21, Skanska will host a public webinar: Navigating Choppy Waters: Opportunities in an Uncertain Market, where Skanska leaders will be joined by industry economist, Jay Bowman of FMI Consulting to unpack the latest report findings and examine how tariffs and federal policies are reshaping the construction landscape. The session will explore regional economic trends, highlight key challenges, and identify where new opportunities may be emerging across the U.S. market. Learn more and register HERE.